Monday, September

22, 2000 6:00 pm Eastern Time

Copyright: Parish & Company

Back to Parish & Company Home Page

Note: Blog Created September 2007 with Updated Comments

see billparish.wordpress.com

CISCO SYSTEMS WATERED STOCK SCHEME

Note: Relationship to Microsoft and Citigroup

Watered Stock Reports Explained: Microsoft

erected a financial pyramid scheme, using employee stock options, designed

to leverage growth in its stock price. Cisco Systems competitive

response, as detailed in this report, involved using a merger scheme designed

to leverage growth in its own share price. What neither company anticipated

was the impact of Citigroup, See

Report on Citigroup, quietly using a merger scheme similar to

Cisco's, in addition to a variety of predatory practices designed to generate

merger fees through its Salomon Smith Barney subsidiary. While all eyes

are on technology, Citigroup has effectively unplugged the new economy

due to excessive mergers and their various peripheral implications, in

addition to becoming a watered stock itself. This may represent the

biggest untold story in the financial media and also the greatest

overall risk to the stock market and economy. This situation at Citigroup

was enabled by Microsoft's orchestration of a breakdown in financial reporting

standards.

No one doubts the remarkable transformation brought about

by the Internet. It has ignited a whole new era of economic prosperity.

With an 85 percent market share in routers Cisco has certainly seized this

opportunity and seen its stock market value soar to half a trillion dollars.

The best and brightest students at MIT and Stanford are in awe of the company,

making it their destination of choice. Even consumer advocate Ralph Nader,

a strong advocate of employees having an ownership stake in their company,

has one-third of his entire portfolio invested in Cisco Systems stock.

Leading socially responsible mutual funds and most growth funds are also

heavily invested in the company.

Meanwhile, Cisco Systems remarkable market capitalization

is supported by only $20 billion in total revenue and represents a mere

$2.35 in sales per share. The current share price is $67 and there are

8.5 billion shares of stock outstanding, including options. It's

the 8.5 billion shares outstanding that deserve more attention along with

the illusion that Cisco is rewarding employees with stock options when

in reality employees are prepaying their own wages while management pilfers

the retirement system in a desperate attempt to sustain their financial

scheme. A scheme largely based upon Microsoft like anti-competitive

business practices still unknown to the general public.

Cisco claims that "everyone is doing it" yet this report will confirm

that this is simply not true. One notably exemption, however, is

Citigroup, which now has 4.5 billion shares outstanding and is the largest

bank in the country with a market value of $230 billion. Citigroup

is using a similar merger scheme and the equivalent of a "fee mill" to

sustain its stock price. This includes aggressively selling high

priced annuity contracts into pension plans and various other practices,

the exact opposite one would expect in a period of increased automation

and efficiency. See summary 3 page report on Citigroup.

For the new economy to regain its footing, industry dominating predators

like Cisco Systems and Citigroup must first be exposed for what they are

doing. This will allow consumers to instead focus on the many excellent

alternatives available, both as consumers of financial services and as

investors.

Cisco Systems Key Financial Data for Fiscal 2000 -

$ Billions

Gross

Margin

$12.2

Companies Purchased Using Purchase

Accounting

4.9

Companies Purchased Using Pooling

Accounting

15.9

Charge to Earnings for Cost of Pooling Mergers - Prior

Years

0

Charge to Earnings for Cost of Pooling Mergers - Current

Year

0

Unrecorded Wage Expense for Options

Exercised

7.1

Unrecorded Remaining Option Wage Debt to

Employees

40.0

Reported Pro Forma Net

Income

3.9

Reported Net Income per SEC

Rules

2.7

Interest and Other Income (21 Percent of SEC Net

Income)

.6

Federal Income Tax Paid on Reported

Profits

0

Undisclosed Actual Loss After Options and

Pooling

(8.9)

(Note that actual loss respresents 75 percent of gross margin)

The above data will be examined in detail later in this

report with links to all source material. Included will be a recap of acquisitions

by company based on data obtained from Cisco's web site and SEC reports.

While Cisco is including the sales from these companies acquired in their

results, they are excluding most of the cost of the acquisitions.

Without this financial deception, Cisco's growth rate would fall sharply

and they would no longer represent 3.5 percent of the entire S&P 500

Index. This is important because now 3.5 cents of every dollar contributed

to most public pensions, since the majority of these plans are linked to

the S&P 500, is going to the purchase of Cisco stock. The scheme basically

enables Cisco to pilfer the public pension system.

Two weeks after receiving this report and calling me to discuss its

findings, in a bizarre act of astonishing integrity, Ralph Nader called

a special press conference on the steps of Cisco Systems to discuss its

findings and denouce these practices, a transcript of which can be obtained

from the San Jose Mercury News. His noble response when asked if he would

sell the stock and other comments will be discussed later. Ralph

Nader now realizes that we are subsidizing Cisco Systems as the equivalent

of a tax exempt entity for federal purposes.

My focus continues to be Cisco Systems impact on the retirement system

and its undermining the economy due to predatory business practices.

Although I receive numerous requests to support various initiatives regarding

legal actions for financial fraud, this is of no interest at this

time.

Why Anti-Trust Compliance Is Now More Important

This scheme at Cisco Systems has now led to widespread

violations of the Hart Scott Rodino anti-trust laws. Cisco

has often boasted about wanting to be the Microsoft of telecom and, while

Silicon Valley became obsessed with Microsoft, one of their own was busy

creating a more threatening monopoly that could dereail the entire tech

based economy. What is unique about Cisco is that customers unable to afford

the product can't simply copy the software to get buy or launch a business

and then later purchase it, as often occurred with Microsoft. Also

unique to Cisco is their boasting of various billion dollar markets with

no apparent interest in reducing costs to enable more users. This is a

stark contrast to Intel's sensible strategy from which we have all benefited.

As Microsoft discovered, sustaining a pyramid scheme

requires progressively more abusive business practices. One need only examine

the recent announcement with Net2Phone, a company with a reported 40 percent

market share of Internet based long distance calling service. Net2Phone's

most valuable high margin product, network management software, will be

placed in a new company, ADIR, and made a standard feature in Cisco's routers

and offerred to other competing telecom companies with similar products,

leaving them to compete for the remaining low margin highly competitive

calling business. Cisco appears to be the only minority investor in ADIR.

The irony is that Cisco's major telecom cusomers including

Sprint, MCI/Worldcom, AT&T and others don't seem to have figured out

that, like Microsoft had done, Cisco is not only providing them equipment

but also going after their core future customer revenue base. Many

other similar examples exist in other telecom related markets including

content delivery and storage services in which Cisco is implementing the

same strategy.

Already these leading telecom companies are scaling back

expansion because, as a study by Lehman Brothers notes, they must now spend

$2 on equipment to generate $1 in revenue on which they may earn 10 cents

if they are lucky. Cisco has effectively boxed out "low cost" more

efficient producers such as Intel through a variety of financial techniques,

in particular the pooling method of acquisitions, and is now placing the

tech sector in particular, in addition to the general economy, at risk.

Cisco summarizes its monopoly position best by highlighting their ability

to provide "end to end solutions" based upon using what are called "Ecosystems

partners." These will be explored in great detail yet to begin

with let's refer to the following story.

Don't

Underestimate Telecom Troubles by Jim Seymour of Thestreet.com, September

22, 2000.

Seymour claims that this year phone companies need to invest $3 in

equipment, more than the Lehman analysis, to generate $1 in revenue and

that this will become $4 next year. He also notes that due to rampant mergers

in the industry "With fewer buyers out there, fewer pieces of telecom gear

will be bought." Already equipment makers are financing their customers

purchases, some would argue subsidizing, he adds. It is noteworthy that

substantially all the mega mergers in telecom have been done using the

pooling method, mergers that would not occur without this accounting loophole.

These high telecom prices are already having a crushing impact on the

proliferation of the Internet. One might ask, what if Cisco were

to drop its prices 50 percent? They certainly claim to be profitable enought

to do so but sadly they have become slave to a financial pyramid scheme.

A good example of this dilemna involves ICG Communications, a key Cisco

customer, whose stock has dropped from a high of $39 to .75 on September

22, 2000. ICG handles 10 percent of the nations dial-up Internet

traffic, serving more than 700 cities.

Milberg

Weiss Announces Class Action Suit Against ICG, Business Wire September

22, 2000

The suit claims that management failed to disclose that "the Company

was experiencing significant and severe customer-service issues which had

arison from network outages, equipment failures and technical problems."

According to an August

1, 2000 Cisco press release ICG uses an "end to end Cisco Powered Network"

and according to a January

27, 2000 ICG press release the company may have received $240 million

in funding from Cisco Capital.

It is most unfortunate that since my initial report Lucent and others

have been severely criticized for making loans to customers. The

truth is that this generally makes good long term business sense and breeds

loyalty, a good thing. What does not make sense is financing equipment

that does not work and thereby impairing your customer's business.

Later AMC, another telecom company that is now suing Cisco after having

gone bankrupt over similar service and equipment problems, will be examined.

This company owes Cisco Capital more than $50 milllion.

Together these two companies alone, ICG and AMC, could possibly owe

Cisco Capital almost $300 million, and both have interestingly experienced

what they call severe customer service and equipment failure issues associated

with their networks, both of which according to Cisco are "end to end"

Cisco solutions. If true, this is probably not unlike Microsoft issuing

NT before it was ready and many companies inappropriately using it for

critical tasks.

The Big Players and a Historical Perspective

Cisco Systems is using techniques no different than those

used by Charles Keating. Many forget that Keating was a hero in his

day, not unlike John Chambers today, with even Alan Greenspan referring

to his bank as "an outstanding success." Sadly, Keating was the catalyst

in destroying a great industry that allowed many consumers to purchase

their first home. Since this report was first published in

late August numerous major news stories have been published outlining these

practices.

You might ask, how does a company become worth half a

trillion dollars with gross revenues of only $20 billion? And why do leading

pension funds including Fidelity, Janus, AXA and Vanguard, which alone

own more than $50 billion worth of Cisco shares, invest in the company?

If $300 billion worth of Cisco shares are in equity mutual funds and other

managed investment accounts, it is likely that more than $4.5 billion in

management and brokerage fees, 1.5 percent, are being siphoned from its

equity base each year. Cisco is often now the most actively traded

security on both the Nasdaq and Instinet.

We will soon see the remarkable answer but first let's

examine a chart and some of the key factors contributing to this situation.

It is important to note that many small and medium size companies are also

very creative on the financial side, a strategy to ignite and grow the

business. Generally, these companies can grow out of these issues.

Cisco, on the other hand, is a giant company that has placed its employees,

shareholders and customers in a mathematical vice resulting from a collapse

of ethics and integrity by management. While they will note that "everyone

is doing it," we will see what is simply false.

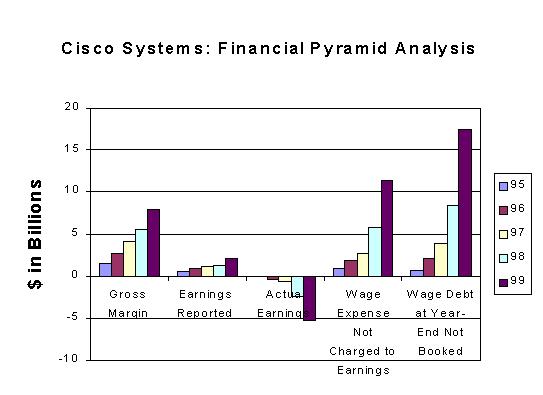

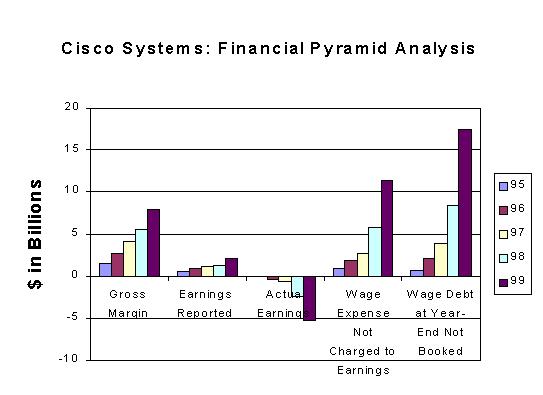

This chart summarizes the impact of stock options for the 5 year period

ending July 31, 1999. It will be updated when Cisco releases its

10K SEC filing for the year ending July 31, 2000. For an extended analysis

of this chart, its assumptions and a downloadable version see the Microsoft

Analysis. Cisco has effectively copied Microsoft's financial

practices in addition to adding innovations of its own that combine to

make it a shining example of financial deception.

Perhaps more interesting is that this chart does not include the impact

of pooling which, if included, would result in a negative taxable income

exceeding $13 billion for fiscal 1999 even though Cisco reported a gross

margin of more than $7 billion.

Other leading companies including Intel, Sun Microsystems and even

Microsoft rarely use pooling and this report will often reference why this

situation is unique to Cisco Systems. This month Sun purchased Cobalt networks

for $2 billion and is using the purchase method. Even Sun is scrambling

to reposition itself and has not figured out that its greatest future competitor

will not be Microsoft but rather Cisco Systems.

Accounting

for Cisco and JDS Uniphase, by Richard McAffery, The Motley Fool, August

23, 2000

This excellent article dispels the myth that "everyone is doing

it." JDS, a key Cisco competitor, does not use pooling for acquisitions.

"It's easier to see," said Steve Moore, vice president of finance at JDS,

in a phone interview. "You get to see the full impact of the deal on the

balance sheet.

Cisco outsources most production, purchases most of its research and

is more focused on integrating others products. For this reason gross

margin was used in the chart rather than total revenues. It is also

noteworthy that Cisco's stock option debt to employees for unexercised

options, according to the Wall Street Journal, now exceeds $40 billion

and this leveraged debt increases more than $800 million with each $1 increase

in the stock price.

Key Factors Leading To "Watered Stock" At Cisco Systems

1) Excessive use of the pooling method

to account for acquisitions, thereby hiding the true cost of acquisition

activity. JDS Uniphase, a top Cisco competitor, does not use pooling.

2) Paying employee wages

mostly in non-qualified stock options. This removes the cost

of labor from the financial statements and overstates earnings because

these wages for options exercised, unlike cash wages, are not included

as a charge to earnings. What Ralph Nader clearly does not understand

is that these non-qualified options are not meant to reward employees but

are rather a scheme to generate cash through non-payment of federal income

tax.

Incentive stock options, ISO's, are the genuine way to reward employees

because they are taxed at the capital gains rate when the stock is sold

yet ISO's do not provide the company with a tax deduction. Cisco Systems

and Microsoft led the conversion from incentive to non-qualified options

because they wanted to generate cash from the tax deductions, thereby selling

out their very own employees, and offloading their entire corporate tax

burden. Employees at times pay a combined rate of 60 percent when

they exercise non-qualified options, even if they do not sell the stock.

Neither Microsoft nor Cisco Systems now pay any federal income tax.

3) Sales adjustments

now represent a large component of gross revenues and investors should

begin to ask questions. The first question should be, are gross revenues

being manipulated by management? A second question might be

whether leases are properly accounted for.

4) Cisco's auditors, Pricewaterhouse

Coopers, are not independent and are helping disguise the scheme.

This firm also audits Fidelity, Janus, AXA and Vanguard in addition to

co-marketing Cisco's products through its consulting division.

5) Anti-competitive business practices similar

to those used by Microsoft. Cisco is aggressively using what

anti-trust lawyers call a "tie-in" strategy to build and extend its monopoly.

A key focus of the Hart Scott Rodino anti-trust act is to address exactly

this strategy. The act will be explored in detail.

6) A quiet, aggressive and highly

successful public relations effort is lobbying hard to prevent reform.

Microsoft could learn a lot from this approach used by Cisco Systems.

A key focus is Phil Gramm of the Senate Banking Committee, which oversees

the SEC, in an attempt to lobby Congress to overrule SEC mandated reforms.

Cisco Systems Becomes a Financial Pyramid

The basic problem is that Cisco Systems tried to emulate

and thereby hold back Microsoft as they both migrate toward aggressively

competing more and more for the same network software management space.

Clearly, Microsoft would like to reduce Cisco to a more hardware focused

vendor. Cisco's response has been to unleash a competitive fury.

Cisco boasts that it will acquire 25 companies this year, many software

related, by simply issuing more shares of stock that are never accounted

for in the financial statements.

This is done by using what accountants call the pooling

technique for acquisitions. As with the excessive issuance of stock

options to cover wage costs, no cash is required and such costs are not

reflected in the financial statements. The only direct cost for pooling

and options is a small amount of ink toner and paper used to print up new

stock certificates on the equivalent of a photo copy machine.

Even Microsoft rarely uses pooling because using it temporarily

prevents a company from being able to do share buybacks to reduce dilution

from its stock option programs. Such buybacks are an important part

of Microsoft's scheme yet the SEC prohibits Cisco from doing buybacks due

to Cisco's use of pooling for acquisitions.

Pooling, already outlawed in most countries, was scheduled

to be repealed by the Securities and Exchange Commission in December. Cisco

has since mounted a quiet and furious lobbying effort and already pushed

the repeal back 6 months to June 2001. John Chambers himself, as

reported in the Washington Post, recently gave $210,000 to

a small group of Congressmen just before they wrote a letter to the Financial

Accounting Standards Board of FASB criticizing the proposed change. A Cisco

spokesman said the timing was a coincidence according to the Washington

Post. Some are now even speculating that either a Bush or

Gore presidency would prevent a repeal of pooling. Joe Lieberman,

Democratic Vice Presidential candidate, has also been a strong defender

of pooling as has George W. Bush..

In addition to pooling, Cisco Systems is also simultaneously

issuing a large number of employee stock options instead of paying cash

wages. The wage expense for the options exercised is not shown as

a charge against the company's earnings even though the company gets a

full tax deduction for such wages. This explains why Cisco Systems

no longer pays federal income tax, even though they report billions in

profits, as reported in a front page NY Times story on June 13, 2000.

The company has offloaded its entire tax burden to employees who, along

with the retirement system, are being left with inflated shares.

In addition to the options exercised and not charged to earnings as

wages, Cisco also owes its employees more than $40 billion in unexercised

options still outstanding that are similarly not reflected anywhere in

the financial statements. While employees sincerely believe that these

options are designed to reward them for hard work done they are really

part of a scheme for management to generate cash via non-payment of federal

income tax and pocketing the exercise price paid by employees.

Older employees may not be concerned as they tell younger recruits to

Cisco's scheme of their significant gains. Some may even comment,

look at the parking lot, does it look like we are being taken advantage

of? Newer recruits would of course benefit greatly if the exercise

price on their options were $10 rather than $60 yet this would greatly

impact the existing participants in the scheme. Old participants

therefore aggressively promote the stock's merits on a product level yet

ignore the financial implications.

The most ingenious aspect of Cisco's scheme, however,

is that by using a combination of pooling and stock options to understate

costs, it can then focus on manipulations of gross revenues and undercut

competitors with self financed leases to sustain its pyramid. This

is where leasing may indeed play a key role in manipulating what analysts

call top line revenue growth.

Analysts at leading mutual fund companies such as Janus

and Fidelity are highly focused on this area but need to sharpen

their pencils, especially given the arrival of tax loss selling season

for major mutual funds, many of which have an October 31 year end.

Janus alone has incurred dramatic losses on certain stocks

including Nokia and WebMD. These losses will allow Janus to reduce

holdings of Cisco Systems without having to pass capital gains taxes through

to its mutual fund shareholders. Clearly, Janus does not want to

give investors negative returns for the year in addition to a bill for

capital gains tax. It is unfortunate that Janus doesn't seem to

make much of an effort with respect to tax planning, even though such an

effort could greatly benefit its mutual fund shareholders.

Let's now examine the following trend per Cisco's SEC

filings. Note that sales adjustments relative to the prior period

sales are increasing and look to be progressively overstated in what could

be an undisclosed "shell game."

Quarter End

Fiscal Year

1997

1998

1999

4/30/2000

Net

Sales

$6,452

$8,488

$12,154

$4,919

Sales

Adjustments

$ 107

$ 351

$

522

412

% of Current Year Net

Sales

1.7%

4.1%

4.3%

8.4%

% of Prior Year Net

Sales

N/A

5.4%

6.2%

12.9%

In an era in which missing earnings projections by a penny

can cause a company's stock to drop 30 percent, these are very sizable

adjustments. It is also likely that they pertain to prior periods

sales. Cisco's 10Q describes these as being attributed to "credit memos

and returns," a reference best found by doing a browser search for "sales

adjustments." Later we will see why learning what percent of these

adjustments pertain to operating leases is so important.

Helpful links to Cisco Systems Financial Related Reports:

Cisco

Systems 10Q SEC Filing for Quarter Ending April 30, 2000

One would also expect Cisco Systems auditor, Pricewaterhouse

Coopers, to more adequately disclose leasing and the nature of the

sales adjustments in the SEC filings, in addition to their own auditor

independence issues. Not only does Pricewaterhouse audit some of

the largest pension funds and owners of Cisco Systems stock in the nation,

including Fidelity Investments (Magellan), Janus (Stilwell Financial),

AXA Financial and the Vanguard Group (Index 500) yet the company also co-markets

Cisco's products through its consulting division along with auditing Goldman

Sachs, Cisco's key investment banking partner. These are serious

conflicts of interest.

List of top 10 institutional

holders of Cisco Systems stock per Yahoo.com

Also note that a large block of Cisco Systems stock is held by various

public and private pension systems not listed. These holdings often

result from indexing and many of these pensions are also audited by Pricewaterhouse

Coopers.

Summary of Insider

Stock Holdings of Cisco Systems stock per Yahoo.com

Insider holdings amount to only 2 percent. At Microsoft, Oracle

and Intel the percents are 26, 25 and 7 percent respectively.

Fidelity's

Top Holdings on June 30, 2000 by Ian McDonald of TheStreet.com

This article confirms that Cisco Systems is Fidelity Investments top

holding. This is important because Fidelity has greatly increased

its position, even after receiving my research materials outlining this

"watered stock scheme."

Janus

Top Holdings on June 30, 2000 by Ian McDonald of TheStreet.com

This article indicates that Cisco Systems was the number 2 overall

holding at Janus on June 30, 2000. Number one was Nokia which has

declined sharply, resulting in a multi-billion dollar loss for Janus.

Another large decline for Janus occurred with WebMD in which they lost

more than 75 percent of their investment in 6 months. A good question

is whether Janus will reduce its Cisco stake and offset these gains with

losses on Nokia and WebMD, thereby not sticking investors with both negative

returns and a tax bill at year end given Janus poor performance this year

in certain funds.

1) Cisco Systems Uses Pooling To Remove The Cost

of Acquisitions From Its Financial Statements, Thereby Grossly Overstating

Future Earnings

If you poll ten people on the street and ask them what they know about

pooling you are likely to get a blank stare. Most mutual fund managers

might attempt an educated response but they too are generally in the dark.

The irony is that this technique used for acquisitions is quickly destabilizing

the stock market and underlying economy in what will undoubtedly be looked

back upon as a ridiculous fraud. It should indeed be a primary issue

in the upcoming Presidential campaign.

Meanwhile, Cisco Systems has orchestrated an aggressive lobbying effort

designed to lobby Congress to overrule the SEC in its attempt to repeal

pooling. The SEC is overseen by the House Banking and Senate Finance

Committees and Phil Gramm, Chairman of the Senate banking committee, has

been a key focus of Cisco's lobbying efforts.

Pooling allows one company to purchase another by simply printing up

more stock certificates with no cost for this activity being reflected

on the financial statements, hard to believe but true. This greatly dilutes

existing shares and creates enormous future pressure on the acquiring company

to meet future earnings per share expectations, usually resulting in large

staff and benefit reductions, except at Cisco Systems.

Pooling is not unlike someone taking your beloved cup of morning coffee,

pouring it into a 15 gallon barrell full of water and then refilling your

cup from the same barrell. Your coffee, and in Cisco's case its stock,

has been watered down.

Have you ever wondered why so many mega mergers are occurring and why

so many quality jobs are being lost and underemployment created?

We can’t hardly blame NAFTA or the WTO for the Verizon strike because these

workers are service technicians mostly based in the U.S. The answer

might be pooling because it gives management a blue print for large future

layoffs and benefit reductions, supposedly based upon market conditions,

when in reality many of these workers may be highly productive and cost

effective. The problem with pooling is that too many shares become

outstanding, thereby forcing job and benefit reductions to meet earnings

expectations.

Later their jobs may be replaced with new workers at lower wages as

the value of top executive stock options is leveraged upward followed by

widespread executive retirements and ultimately a collapsing stock price.

Pooling is also a root cause of conversions from defined benefit to cash

balance pension plans at Cisco's competitors as they skim off pension assets

to inflate earnings and try and compete with Cisco's scheme for investment

capital. Leading financial publications such as the Wall Street Journal,

Barron’s and Bloomberg are calling pooling a massive deception. These

publications have still, however, failed to link the impact of pooling

to excessive stock options grants and Cisco's manipulation of gross revenues

not fully disclosed by their auditors and the resulting impact on competitors.

Cisco Systems Acquisition Summary for Fiscal Year 2000:

Click Here to See Summary of Key Details

by Company

The above link accessed a simple table summarizing key details for

each acquisition.

$ Millions

Fiscal 2000 Purchase

Pooling Transactions

4th

Quarter

1,390

6,801

8

3rd

Quarter

2,850

922

5

2nd

Quarter

135

7,353

6

1st

Quarter

590

907

5

Total

$4,965 $15,983

24

The total value of the 24 companies acquired is $20,948

with pooling based mergers representing 76 percent of the total.

This amount itself exceeded gross annual revenues and represents almost

two times Cisco's gross margin. Of those companies acquired, $4,965

were paid for using the purchase method for mergers on which Cisco Systems

took an immediate R&D write-off of $1,373 or 27 percent of the purchase

price.

This purchased R&D write-off represents approximately 25 percent

of the pro forma income before taxes of $5,589. Clearly, Cisco is

using the purchase method for acquisitions and large R&D write-downs

to suppress its current earnings in order to make future periods look more

favorable and thereby manipulate its stock price. Since these write-downs

are not included in "pro forma" earnings, they then boast of record profit

growth at the same time.

Cisco must purchase its research because it has the same problem as

Microsoft. Although good at integrating other peoples products, Cisco

Systems has a very poor current record for internal product development

compared to other leading technology companies such as Lucent, Intel and

Sun.

Helpful links to understand the pooling method for

acquisitions:

Firms resist effort

to unveil true costs of doing business," USA Today July 3, 2000;

This link is to the archive at USA Today from which the above article

can be purchased. The article noted that "But a recent study by McKinsey

& Company, a consulting firm, labels Cisco's argument a myth. According

to McKinsey, rules banning "pooling" wouldn't damage profits or shareholder

value. Rather they would require companies to look more closely at deals

and communicate more with stockholders."

A

Tech Push to Keep 'Pooling' on Books, By Albert Crenshaw, The Wash Post,

June 25, 2000

CEO John Chambers gave $210,000 to a few Congressmen just before they

wrote a letter to the FASB criticizing the proposed change. A Cisco spokesman

said the timing was a coincidence. The article also notes that Barron's

estimates that Cisco Systems would have had its $2 billion in earnings

last year wiped out if it hadn't been able to use the pooling loophole

as it acquired several smaller companies.

Cisco's

Genius, by Thomas Donlan, Barron's cover story, May 8, 2000

Donlan notes that "Cisco Systems is a great company. But its

success in part reflects its prowess in financial engineering. And therein

lies a host of dangers ignored by investors." He adds that "Cisco is a

modern house of cards, in which the cards are Cisco stock and the companies

acquired for Cisco stock."

"Cooking

the Books," the Public Broadcasting Service (PBS) by R. Cringely, May 27,

1999

This article notes that "... there remains in the telecommunications

and data communications industries another clever use of accounting to

build sales. It's frightening to think of how much of the Internet, for

example, has been built with this technique that is commonly used by companies

like Cisco Systems..."

2) Cisco Systems Removes Wage Expense From The

Income Statement Via An Employee Stock Options Loophole, Thereby Further

Inflating Earnings

Cisco now reports billions in profits and pays no federal income

tax, as reported in a NY Times front-page story on June 13, 2000.

This part of the scheme is so successful that Cisco has even recognized

a special asset titled Deferred Tax Credits which represents accumulated

tax credits from this activity that can be used to offset future income

tax obligations.

Cisco pays most of its wages in stock options because by doing so they

get a tax deduction for wages yet these wages do not require a cash outlay

nor are they recognized as a charge to earnings due to an accounting loophole.

At the same employees must also pay an exercise price to take ownership

of the shares which is effectively a means in which Cisco is having its

employees pre-pay their own wages as part of the scheme, generating even

more cash. Remarkably, employees are taxed at ordinary income rates

when they exercise options even if they do not sell the stock.

Wages paid in cash not only deplete cash but are also shown as a charge

to earnings and thereby lower profits and interest in a company’s stock.

Can you see the picture now? If your employer is paying you cash wages

and benefits, your company is being progressively destabilized by this

scheme because you will be rendered non-competitive, whether you have a

traded stock or are a private company because all companies compete for

the same pool of investment capital.

Since Cisco owes more than 800 million shares in stock options to employees,

this debt is leveraged and increases $800 million for every $1 increase

in Cisco's stock price. Clearly, the only winners in this scheme

are now mutual fund companies such as Janus and Fidelity that earn management

fees off this pyramid scheme. In the future, however, as this scheme unravels,

either company could be saddled with crippling losses and legal judgments

for failure to meet their obligation to mutual fund holders. Somehow

they have forgotten that their customer is the mutual fund holder, not

the companies like Cisco they are invested in.

This is why the overall stock market has been relatively stable on a

historical basis yet within the overall indexes dramatic variations are

occurring from company to company. Capital is moving into this pyramid

scheme as Cisco Systems, emulating Microsoft, destabilizes not only the

U.S. stock market but also the global economy.

On September 23, 2000 Intel declined 23 percent in one day upon announcing

that its earnings would be less than forecast. If Intel were using

all of Cisco's financial techniques they would instead be reporting record

profits. We should all be concerned about this stock market volatility

because, although trading firms can post record profits, it can also undermine

investor confidence.

The

Sea is Calm. The Pond is Choppy by Mark Hulbert, NY Times, August 20, 2000

This story highlights this pattern of stock market volatility but does

not link it to the Microsoft/Cisco Systems pyramid scheme

Communications Workers of America

Home Page and Contact Information, Including Email Addresses

The CWA is the most important and powerful union in the communications

industry. It now has a good opportunity to stand up and help the

telecom companies its workers serve including Sprint, AT&T and MCIWorldcom

to challenge Cisco's monopoly and financial practices in order to bring

prices down and preserve jobs. The irony is that the key unions in the

communications industry, most notably the Communication Workers of America,

have not made a big issue of pooling and stock options. What this

means are dramatic future reductions in union jobs as traditional phone

companies and equipment providers become non-competitive with this scheme?

Some try to play the game, including Lucent, but with 150,000 employees

receiving mostly real cash wages and benefits, compared to Cisco’s 30,000

employees receiving mostly stock wages, Lucent can’t compete and already

has a cash flow problem even though Lucent's annual revenues of $36 billion

are almost twice those of Cisco Systems.

What Real

People Say About Inflation by J. Crudele of the New York Post, September

11, 2000

Crudele properly highlights that the government's statistics on inflation

need updating. The sad fact is that since stock option wages are

not included in the wage inflation statistics reflected by the Employment

Cost Index (ECI), workers negotiating with management are at a severe disadvantage

in getting increases that keep pace with inflation. They have to compete

with stock option wages for education, housing and other products and services

yet the effort is rigged against them.

Mutual

Funds Thrive Even If Funds Don't by John Waggoner, USA Today, August 8,

2000

This article confirms the situation noted above. By Cisco Systems inflating

its market value $200 billion the investment industry is able to extract

combined management fees and trading commissions of at least $3 billion

annually.

Also noteworthy is that large public pension fund providers such

as State Street, even though they may charge low fees to pension plans,

also have significant Cisco holdings in other funds with much higher expenses,

including load fees. Public pensions large holdings in Cisco stock are

effectively enabling State Street to gouge mutual fund holders outside

of the pension plans in a tacit form of price control.

Helpful Links To Understand The Impact Of Stock Option

Programs:

"The

Tangled Web of Stock Option Grants" by Graef Crystal of Bloomberg, August

8, 2000

Crystal provides an excellent history, new research summarizing the

impact of excessive options and also notes that the British are now considering

reforming these practices.

"The

misleading reporting of stock options." by Thomas G. Donlan of Barron's,

August 7, 2000

Excellent background and interpretation. Donlan notes that options

"deserve to go under the inquisitor's hot lamp as another dubious tax subsidy

that perverts good sense and harms the owners of the corporation that issues

them."

Nokia

Rocks Janus by Michael Santoli of Barron's, July 31, 2000

In this article Scott Schoelzel, manager of Janus 20, is quoted as

saying "In retrospect, I may have skewed the fund a little more toward

emerging growth opportunities." This validates my theory that the

excessive concentration of capital in a few companies, i.e. the pyramid

scheme, had destabilized and undervalued emerging markets. The irony

for Janus is that they missed the emerging market opportunity and are now

left sitting on inflated shares of Cisco Systems and likely to inflict

multi-billion dollar losses on pension plans invested in Janus funds..

"Options

May Swamp Tech Investors" by R McGough, Wall Street Journal, July 28, 2000

McGough notes that issuing millions of shares to employees and then

using ever higher levels of earnings to buy back shares so they can go

out and issue millions more shares to employees sounds more like "a gerbil

running on an exercise wheel than a recipe for business growth." The article

focuses on Microsoft and Cisco Systems. My theory, of course, is

that this is more indicative of a pyramid scheme in which employees are

prepaying their wages and the retirement system is being pilfered.

3) Cisco Systems and Significant "Sales Adjustments"

To Gross Revenues

In order to understand the impact here, let's begin by

asking a few questions based upon Cisco's summary of net sales for the

period ending 4/30/2000. All we can do is speculate because Cisco

provides almost no disclosure in its 10K SEC filing regarding the activities

of Cisco Capital, its wholly owned leasing subsidiary. We will therefore

reconstruct the significance of Cisco Capital utilizing various external

sources.

To achieve this we will need to maintain a laser focus

on two numbers that appear on Cisco's balance sheet. The first is

deferred taxes receivable, an asset, and the second is deferred taxes payable,

a liability. This is the same technique

used to discover that neither Microsoft nor Cisco Systems now pay any federal

income tax. Any additional external sources you may have to

support this study would be much appreciated. Many of you many still

wonder how I reconstructed Microsoft and Cisco's tax returns yet it is

as simple as this.

My intial belief, unconfirmed, is that the asset deferred taxes receivable

are credits Cisco is taking on stock option deductions that are yet to

be used since they already pay no federal income tax. The offset

would be to equity, meaning that return on equity is being affected by

significant unrealized tax credits. Other companies such as Amazon.com

also have these credits yet since they don't forsee the profits to be able

to use them, the credits are not booked as an asset.

This is how the federal budget has been balanced on the backs of

Microsoft and Cisco Systems competitors. These unprofitable firms have

paid massive federal income tax via employees exercising options yet haven't

been able to offset these taxes with a corporate tax deduction. Microsoft

and Cisco have come close to a complete offset and thereby print cash in

the form of lower taxes.

The second deferred tax amount shown as a liability on the balance sheet

is most likely related to a timing difference on lease accounting, not

unlike depreciation. Even though Cisco may amortize an operating

lease over 3 years for book purposes, on the tax return they may be using

accelerated MACRS amortization.

Cisco Capital focuses on operating lease sales

and these are generally recognized using the installment method.

For example, if I sign a 3 year lease for a Cisco router that costs $300K

my annual expense is $100K and Cisco's income booked is $100K. What

this means is that a significant amount of Cisco's current sales may indeed

be for equipment sold 1-2 years ago, equipment that can at times be obsolete

in less than one year. This makes Cisco's sales non comparable to

other competitors such as Juniper.net who do almost no leasing because

Juniper's sales are for newer products. Even though Cisco has future lease

payments receivable not yet booked as sales, we'll see why this is less

of an advantage than one would think.

In addition, any non-payment of receivables at Juniper must be recognized

as a write down to receivables and a charge to earnings. In the mid-1990's

when Intel announced that a major customer, Packard Bell, was having

difficulty and that their account receivable would be reclassified to a

loan receivable, Intel's stock dropped sharply. The point is that

the quality of receivables is very important in evaluating any company.

Auditors failure to adequately examine receivables has resulted in numerous

successful lawsuits from investor groups.

Cisco

Faces Lawsuit Over Gear, Business Practices, Cnet, June 12, 2000."

Other questions that might be asked, alluded to in this article, include

whether or not Cisco's lease customers are paying a finders fee to those

who arrange for financing through Cisco Capital and whether or not these

people have a direct relationship with Cisco. This article highlights a

few of these issues involving a customer owing Cisco $50 million who filed

for bankrupcy in August 2000.

Cisco Capital is A Wholly Owned Subsidiary of Cisco

Systems

Cisco Capital implies that most of its leasing activities

involve self financed operating leases, meaning that they do not generally

rely on banks and other external sources for funding. Meanwhile,

most competitors are unable to self finance leases because they have wages

and material costs that require cash outlays. Companies that attempt

to compete in the leasing area, most notably Lucent, often run into a cash

flow problem.

This could be one of the more ingenious aspects of Cisco's

scheme, that is, generating cash via non-payment of federal income tax

and preserving cash by paying for acquisitions and employee wages with

mostly stock. Other top technology companies regularly purchase companies

for cash, including Intel, yet Cisco is mostly focused on paying for such

acquisitions with stock. This cash can later be used to finance leased

sales, providing a significant competitive advantage and allow Cisco to

use leasing as a competitive weapon.

It is also speculated that Cisco Capital often takes stock options

from companies to which it sells equipment as part of the deal. This could

be very important because Cisco could thereby eliminate taxes on any such

investment gains by offsetting the gains with its own stock option program

deductions. They would have effectively created a mechanism, especially

with pre-ipo options in which gains can be significant, in which large

gains could be incurred with no tax consequence. Since Cisco personnel

are often on the technical boards of such customers it would seem possible

that they could also influence the stock price and resulting gains.

Even if Cisco's equipment were overpriced and lagged technologically,

many organizations may choose it due to the lease program and cause a "dumbing

down" in quality with respect to the basic Internet infrastructure. More

importantly, this can stifle innovation and result in foreign competitors

gaining markets that could have been led by U.S. based firms. It

could also lead to government inefficiency as officials opt for Cisco's

3.9 percent lease rate.

It is important to note that collapsing Cisco's pyramid

scheme should cause prices to plummet for Internet infrastructure and thereby

allow many companies in a variety of industries to expand and add more

jobs. The exact opposite is now occurring as large layoffs and union

conflicts have been ignited by this scheme as other companies are unable

to effectively compete for capital to upgrade equipment and respond by

merging using pooling, laying off large numbers of workers, converting

pensions to cash balance plans and instituting other wage and benefit reductions

designed to increase earnings.

Useful Links In Examining The Activities of Cisco Capital:

"You

Can Bank on Cisco--Literally" by Scott Moritz of Thestreet.com, September

19, 2000

Moritz quotes Cisco's Michael Volpi that roughly 10 percent of Cisco's

sales involve vendor financing or lending customers money to buy equipment.

Volpi added that less than 1 percent of the financing deals have gone sour.

This is a surprising statistic given that one customer alone, AMC, has

gone bankrupt and left significant losses. It is also noteworthy

that Cisco's auditors, Pricewaterhouse Coopers, consider this activity

not significant enough to more adequately disclose in the financial statements.

"End

Game for Cisco?" by Luciano Siracusano of Invididual Investor.com, September

15, 2000

This article identifies four pillars Cisco has stood on that have become

unstable. One such pillar identified is that Cisco reports billions

in profits and now pays no federal income tax. Luciano was also featured

on a video version of Yahoo Finance the same day.

"Telecomm

equipment provides may regret loans" Barrons, September 3, 2000

This article highlights the risk in lending to customers and speculates

on where many service providers will find the financing to build out their

networks.

Link

to Cisco Systems SEC 10K Filing

A search using the term "customer financing" will reveal the only mention

with respect to Cisco's leasing activities. In this brief description

with no supporting financial details Cisco notes "We are experiencing increased

demands for customer financing and leasing solutions, particularly to competitive

local exchange carriers ("CLECs")."

Cisco's

customer files for bankruptcy by Wylie Wong of CNET news, August 17, 2000

AMC is suing Cisco for $62 million, claiming faulty equipment and conflicts

of interest among Cisco employees. AMC leased its equipment from

Cisco Capital for $50 million and now refuses to pay because "the products

don't work."

Fiancing

Solutions Available - United States

This page shows the various lease programs available in the United

States. Note the 3.9 % finance program for government and education.

Cisco

Capital Business Directory - Europe

Note that similar directories are available for Asia and other regions,

again highlighting the global reach of Cisco Capital

Technology

Migration Lease Program

Cisco describes this as "An operating lease with a unique upgrade option

that allows you to return leased Cisco equipment before the lease term

is up with generous exchange terms." It is possible, but can not

be proven due to inadequate disclosure, that this area is being used to

manipulate gross revenues.

US Court

Rules Cisco Not Required to Give Bid Information to Competitors Who Lost

Govt Contract Bid

A search using the term Cisco Systems will locate the pertinent paragraph.

Cisco, as with Microsoft, goes to great lengths to keep its pricing policies

secret.

Links to Recent Leasing Transactions with Cisco Capital:

Note that these few recent publicly disclosed transactions alone amount

to more than $750 million. Also noteworthy is that Cisco often announces

vendor financing rather than product sales, again highlighting the importance

of financing for products that are grossly overpriced. It is quite

remarkable that Pricewaterhouse Coopers, Cisco's auditor, does not more

adequately disclose this activity. Some might consider this lack of disclosure

grounds for a legal action.

A common question is, doesn't Intel also have Intel Capital and do the

same thing. The answer is no. Intel Capital is aimed at making

strategic investments in other companies that will help spur demand for

its core microprocessor products. This at times includes helping

a key supplier, for example Micron, through a difficult time.

Korea

Thrunet Announces Vendor Financing from Cisco, by Adam Creed, Newsbytes,

July 26, 2000

This article is available for purchase in the archive and notes that

"Broadband Internet access provider Korea Thrunet has obtained $120 million

in financing from Cisco Systems Capital Corp.

Cisco

sees South Korea Sales, by Reuters, June 14, 2000

Cisco signed a letter of intent today with local telephone and Internet

service provider Hanaro Telecom, under which Cisco would provide $200 million

in "supplier financing" over three years.

DSL

Provider secures $120 million from Cisco Systems Capital, Press Release,

April 12, 2000

Cisco provided $120 million in financing to Harvardnet, noting that

95 percent of the company's network infrastructure is Cisco Equipment.

Cisco Capital Provides

Hong Kong Start-Up $129 Million in Vendor Financing, March 2, 2000

This is a link to the press release archive at www.diyixian.com.

Diyixian.com is a Hong Kong start-up.

Advanced

Radio Telecom Receives $175 Million from Cisco Capital,

In the Advanced Radio Telecom SEC 10k filing the following is noted

"In November 1999, ART entered into an agreement with Cisco Systems Capital

Corporation to provide up to $175 million to cover ART's purchase of Cisco

equipment and for other network installation and integration costs."

Pricewaterhouse Coopers is also the auditor of record for Advanced Radio

Telecom.

4) Cisco Systems Auditor, Pricewaterhouse Coopers,

Is Deceiving Investors And Could Suffer Multi-Billion Dollar Losses Due

To Legal Judgments As Cisco's Scheme Collapses.

Somehow along the way the average person has discounted the value of

audited financial statements. We can do that as individuals yet Pricewaterhouse

Coopers, along with other CPA firms, have been awarded a monopoly over

the ability to express an opinion on financial statements. The catch

is that they must conform to SAS auditing rules.

The most important SAS rules are those regarding auditor independence.

One need only check the index in a current review manual for the CPA exam

at your local bookstore under the topic independence. You will see

that independence must be established in both fact and appearance and any

failure to do so should result in a "disclaimer" opinion. This alone

should be grounds for a significant and successful legal action against

Pricewaterhouse Coopers for it is an egregious violation.

Less discussed are potential conflicts of interest among board members

themselves. At Cisco one director, James Gibbons, is also on the Lockheed

board, a key Cisco customer. That is fine yet at Cisco he receives

significant stock options and at Lockheed he is on the audit and ethics

committee responsible for overseeing the external auditors. Lockheed is

audited by Ernst & Young who, together with Pricewaterhouse Coopers,

are two key distributors of Cisco's products and services.

Links to Pricewaterhouse Coopers Clients and Other

Audit Related Topics:

Search these SEC filings and other reports using the term Pricewaterhouse

Coopers and you can verify they are the auditor of record for any of the

following organizations.

Cisco

Systems

Goldman

Sachs

Janus

- Part of Stilwell Financial

Fidelity

Magellan-Largest Fidelity Mutual Fund

AXA

Financial

Vanguard

Index Trust 500 - Largest Vanguard Mutual Fund

"The

Investors Champion" by Mike McNamee of Business Week, September 20, 2000

This cover story features a large photo of Arthur Levitt and is titled

" SEC Chairman Arthur Levitt wants to bust up the accounting giants and

clean up bad audits. The stakes are huge." Pricewaterhouse

Coopers, Cisco Systems auditor, is leading an effort to undermine Levitt,

the article notes.

"Cisco Systems", Grant's Interest

Rate Observer, September 15, 2000

Grant's is a high quality subscription only newsletter widely read

in the financial community. This story notes that Cisco Systems seems to

see generally accepted accounting principles as "pedestrian and inexpressive.

To tell its own story in its own voice, a voice it knows Wall Street always

longs to hear, Cisco has evolved its own reporting conventions."

AICPA Lobbies to Prevent New SEC

Independence Guidelines, August 10, 2000

Remarkably, the accounting community via the American Institute of

Certified Public Accountants (AICPA) is aggressively lobbying its members

to undermine the SEC's efforts toward reform. Pricewaterhouse Coopers

is a leader in this effort.

Independence Standards

Board, August 2000

This specially commissioned organization has 9 board members, six of

which are from accounting firms that include the CEO's of KPMG, Ernst &

Young and Pricewaterhouse Coopers. All three of these accounting

firms have significant agreements with Cisco Systems and co-market Cisco's

products and services. Clearly, this board has some severe independence

issues of its own. The only investor rights member on the group is

John Bogle of the Vanguard Group and SEC Chairman Arthur Levitt considered

boycotting the first meeting according to Business Week.

"SEC

Probe of MicroStrategy Focuses on Auditor Independence," Michael Schroeder,

Wall Street Journal, July 18, 2000. One area being probed,

according to the journal, is "whether audit partners encouraged MicroStrategy

to ask its customers and joint venture partners to hire Pricewaterhouse

Coopers consulting arm. The enforcement division also is gathering information

about the practice of audit partners receiving incentive compensation for

cross selling consulting services and whether such a system could cause

a breach of independence standards."

"Auditor's

Entangled in Complex Dealings" by David. S. Hilzenrath, Wash Post, June

18, 2000

This link is to the post archive, from which the article can be ordered

for a fee. The article examines Pricewaterhouse Coopers relationship

with Microstrategy and confirms that the accounting firm directly sold

licenses for MicroStrategy software to various clients in addition to providing

consulting services associated with such sales.

Lockheed

& Cisco Form Alliance For US Government Market, Press Release, May

31, 2000

Cisco will join Lockheed's team in competing for the contract regarding

the next generation of Naval Destroyers. This should be as disturbing

as Microsoft's involvement with the defense department, its top customer,

because in both cases we are likely to end up with inferior products.

Juniper is one example of a router product that greatly exceeds

Cisco's ability and similar comparisons occur in other product lines.

The point is that we need the best defense products, not one that leverages

its way into key contracts, including this Naval Destroyer bid, through

financial engineering.

Lockheed Board of

Directors and Audit Committee Listing

James Gibbons, a Cisco Systems board member, for which he receives

substantial stock options, is also on Lockheed's board and a member of

the Lockheed audit and ethics committee. Lockheed sells more than

75 percent of its products and services to the governement with 50 percent

of their sales going directly to the Pentagon. It is interesting to also

note that Lynne Cheney, wife of Dick Cheney, is also on the Lockheed board.

Lockheed

10K Filing Indicating Ernst & Young Is The Auditor of Record

Ernst & Young is a key distributor and integrator of Cisco systems

products and services.

SEC Appoints

Charles Niemeier To Head New Financial Fraud Task Force, May 25, 2000

"With investor protection as its chief goal, this group will work on

complex and novel accounting issues, and increase the speed at which cases

are brought."

Cisco

Announces Strategies for the Delivery of Software Solutions and Services,

May 23, 2000

This press release from Cisco Systems website highlights a clear conflict

of interest with its auditor Pricewaterhouse Coopers and announces "Comprehensive

Strategies for the Delivery of Software Solutions and Services Relationships

with Leading Consultant and Systems Integrators." These include Pricewaterhouse

Coopers. Cisco adds that "The ICSG consultant integrator program includes

a focus on collaborative sales engagement models." As part of this program,

"ICSG is also collaborating with its consultant integrators to build, pre-integrate

and pre-test business solutions and services replicable across multiple

clients and to transfer critical knowledge that enable consultant integrators

to deliver Cisco-enabled solutions and scale the number of consultants

trained on ICSG software."

SEC

Charges Pricewaterhouse with Auditor Independence Violations, January 14,

1999

On January 14, 1999, the Securities and Exchange Commission brought

charges against PricewaterhouseCoopers for widespread auditor independence

violations.

Accountants

in Bank of Credit and Commerce (BCCI), The Guardian Observer, January 8,

1999

This article notes that many consider this the greatest financial fraud

in history which "rendered a bank supposedly worth $20 billion and operating

in 60 countries entirely worthless." Pricewaterhouse audited BCCI for four

years before it failed.

Microsoft

Auditor Alleges Fraud and Is Given Option to Resign or be Fired, ABC News,

January 22, 1999

Charles Pancerzewski, a respected industry veteran and former partner

with Deloitte and Touche, was awarded $4 million under the Federal Whistleblowers

Act in a wrongful dismissal suit. He had told Microsoft that what they

were doing constituted securities fraud.

SEC

Chairman Levitt Speaks on the Breakdown In The Quality of Financial Reporting,

September 28, 1998

This summarizes Chairman Levitt's landmark September 28, 1998 speech

on the breakdown in the quality of financial reporting, what he referred

to as the "numbers game."

5) Cisco Systems uses sophisticated anti-competitive

"tie-in" merger techniques, a clear violation of the Hart Scott Rodino

Anti-Trust Act, in order to build and extend its monopoly.

Under the act, the acquiring company must make a Hart Rodino filing

prior to consumating the acquisition with both the Federal Trade Commission

(FTC) and Department of Justice (FTC) if three conditions are met. Once

the filing is made, the public has 30 days in which to comment yet is unable

to review the filing.

i) One of the parties involved must have $100 million in

sales or assets in excess of this amount.

ii) The other party must have $10 million in sales or assets.

iii) The acquiring party must be acquiring more than $15 million

in assets or voting securities.

Clearly, the act should apply to Cisco's recent investment in Net2Phone.

Anti-Trust's

Future by Jim McTague of Barrons, September 25, 2000

McTague notes that "Bush would not initiate any cases resembling the

current Microsoft litigation. Under Gore, dominant Internet players

like Cisco Systems would have to keep a constant watch over their shoulders."

Even today it strikes me as ridiculous that George W. Bush, while in Redmond

and prior to Judge Penfield Jackson's ruling, would say that if President

the Microsoft case would be dismissed. Both Bill Gates of Microsoft

and John Chambers of Cisco Systems are strong supporters of the Bush campaign

and Bush should stand them both down rather than pander to their financial

schemes that are pilfering the retirement system.

Net2Phone,

Cisco Expand Internet Ecosystem by N. Detourn of the Motley Fool, September

18, 2000

Detourn notes that Net2Phone will spin off its network management software

into a new subsidiary called Adir in which Cisco will be minority

shareholder. Net2Phone claims a 40 percent market share for Internet

based long distance phone traffic yet, as with traditional carriers such

as AT&T, has found the activity highly competitive with low profit

margins.

Net2Phone will market its "hidden jewel" software via this new subsidiary

and joint venture with Cisco by integrating it into Cisco's product line,

a clear "tie-in" anti-trust violation based upon Cisco's existing monopoly.

It is truly ironic that, as with Microsoft, Cisco is now going after the

core revenues of customers to which it sells its equipment including AT&T,

Sprint and Worldcom. Meawhile, these phone companies are trying to

pay wages and build out networks while long distance revenues plummet.

"More

Evidence of Telecom Slowdown" by Scott Moritz of Thestreet.com, September

6, 2000

This article cites a Lehman Brothers study that telecom providers will

need to spend one dollar on capital equipment for every two dollars in

revenue generated. This marks a dramatic increase, the study notes. The

industry clearly suffers from not having a lot cost efficient producer.

Qwest

to Increase Capital Spending, Cut 12,800 Jobs by D. Cimiluca of Bloomberg,

Sept 7, 2000

Qwest., which bought local-phone company U S West Inc., raised its

forecasts for capital spending and plans to cut 12,800 jobs as it invests

more in high-growth businesses. This furthur highlights the potential

that many jobs are being as resources are instead dedicated to overpriced

telecom equipment due to Cisco's monopoly. The link here is to the

archive where the article may be purchased for $2.50.

6) Cisco Systems Legal, Public Relations and

Governmental Affairs Staff, Awash in Cash, Are Corrupting Key Financial

and Governmental Institutions and Destabilizing both the Stock Market and

Underlying Economy.

The following links provide useful background in understanding the primary

forces that have developed this scheme and are working to prevent it from

being disclosed to the investing public. It is quite remarkable that

even Ralph Nader would have one third of his entire investments in Cisco

Systems stock given the ruinous effect the company is having on the capital

markets. This scheme directly effects many of Nader's key concerns

including corporate welfare and environmental related issues as other corporations

are forced to take short cuts in order to compete with the scheme for capital.

Larry

Carter, Cisco's Chief Financial Officer, Background Summary

Mr. Carter has a distinguished background which includes 19 years at

Motorola and he was recently added to the Cisco board of directors.

One

need only closely examine Cisco Systems recent earnings

release on August 8, 2000 to see the remarkable deception being practiced

by Mr. Carter. Key to this is presenting "pro forma" earnings first

and de-emphasizing the second version of earnings that classifies expenses

on the income statement as required in their SEC 10Q filings.

The second paragraph boasts that pro forma earnings increased more

than 60 percent when in reality Cisco is loosing billions as explained

in this report. The consolidated statement of operations does also clearly

indicate that operating income decreased in relation to the same quarter

in the prior year. Remarkably, obvious expenses such as employee benefit

costs associated with stock option wages and purchased research and development

were excluded from these pro forma results in which Cisco boasts a 60 percent

increase in earnings.

CFO to sell

$31.7 million, Gibbons, director, to sell $2.5 million, by Reuters, August

23, 2000

Larry Carter, CFO, filed to sell shares as did James Gibbons, who sits

on Cisco's board of directors. Gibbons is also on the board of a key Cisco

customer, Lockheed Martin, where he also serves on the audit and ethics

committee. Lockheed is audited by Ernst & Young who, along with

Cisco's auditor Pricewaterhouse Coopers, are key distributors of Cisco's

products and services.

Cisco

Systems Government Affairs Staff

This is the listing for Cisco Systems governmental lobbying staff.

They are highly successful and have already pushed the repeal of pooling

back from December 2000 to June 2001.

Cisco

Systems Public Relations Contacts

This is a directory for Corporate Relations, Investor Relations, Marketing

and various other areas.

Brobeck, Phleger & Harrison,

Cisco Systems Outside Legal Counsel

Brobeck handles many of Cisco's merger transactions and also lists

Goldman Sachs as a client. Therese A. Mrozek is the primary counsel for

Cisco Systems and a search under her name will display a background summary

indicating a reference to the work for Cisco Systems. The chairman

of the firms business and technology practice is Carmelo M. Gordian.

FTC ends

Cisco inquiry, by Melanie Austria Farmer, CNET News, June 2, 1999

The FTC ended its inquiry with no action against Cisco Systems

FTC

Looks Into Cisco Meeting, the Associated Press, January 26,1999

The article notes that "Cisco, based in San Jose, Calif., controls

roughly 85% of the world's market for routers, which control the flow of

electronic messages." This is an important statistic for those that

are not familiar with Cisco's market position in this key industry.

The article notes that the FTC was studying Cisco's business practices.

Ralph Nader Related Links:

It seems especially ironic that Ralph Nader would be, unknowingly, a

great enabler of an astonishing financial pyramid scheme. Many socially

responsible mutual funds, like Nader, are heavily invested in Cisco Systems

and fail to see the disastrous consequences the company is unleashing on

the stock market in particular and economy in general.

"Criticism

of Cisco Widens" by Laura Kurtzman of San Jose Mercury News, September

14, 2000

On the steps of Cisco Systems in a special press conference called

based upon receiving this report, Ralph Nader called for more corporate

resonsiblity from Cisco Systems and an end to corporate welfare. Not noted

in the article is that Nader also disclosed that Cisco Systems now pays

no federal income tax on current earnings and that they should pay their

fair share. Taxes paid now are from prior periods.

When asked if he would sell the stock Nader replied, "No, I am not

a quitter." Nader sincerely believes that he has more power to make

positive changes at Cisco while being a shareholder, a nobel and admirable

yet also naive position given Cisco's concurrent efforts to undermine the

SEC's efforts toward reform. My advice to Ralph is to buy the products

and boycott the stock. Only then will Cisco respond.

Nader

Walks Picket Line at Verizon by the Associated Press, August 10, 2000

This article confirms that Ralph Nader joined the Communication Workers

of America on their Picket Line.

Nader

Testifies Before House Budget Committee on Corporate Welfare, June 30,

1999

Mr. Nader testifies at length regarding abusive corporate tax shelters.

This is a transcript of his testimony.

Nader

Acceptance Speech for Green Party, June 25, 2000

By typing in General Electric in your browser word search you can read

the text of his speech in which Mr. Nader uses an example from 1983, highlighting

that the average worker paid more federal income tax than GE in 1983, which

paid none during this time. This is significant because one third

of Mr. Nader's investment portfolio is in Cisco Systems stock, a company

which now earns billions and also pays no federal income tax, as reported

in the NY Times on June 13, 2000 in a front page story. It is

also significant because GE paid mostly cash wages to its employees while

Cisco is using the equivalent of a photo copy machine to pay its employees,

thereby pilfering the retirement system since Cisco now represents 3.5

percent of the S&P 500 and many large funds index off this benchmark.

Nader said

to profit from technology stocks, by USA Today, June 18, 2000

This article confirms that one third of Mr. Nader's total investments

are in Cisco System shares.

Parish &

Company informs Nader of Cisco Systems Financial Practices, September

30, 1998

This press release was issued on PR Newswire and followed with a phone

call and fax to Mr. Nader's organization in October of 1998. Three

weeks later PR Newswire told me that due to objections from Microsoft,

even though my press releases were high quality and newsworthy, they would

no longer be able to issue the releases.

Conclusion and Practical Financial Planning:

As the disclosure of this pyramid scheme at Cisco Systems

begins to be fully covered in the media, it is important to recognize,

as with Microsoft, that Cisco hires a lot of great people. This is

perhaps the irony, that so many gifted people would be so grossly manipulated

by Cisco's management.

We are fortunate, however, that the economy is very strong

and that the stock market is beginning to respond to these situations involving

accounting irregularities. Given the ingenious nature of this watered stock

scheme at Cisco, and difficulty for even top investment professionals to

digest its nature and implications, I have tried to carefully reference

all substantive facts in the section titled "special resources for journalists."

For Cisco employees it might be especially important to note that many

of you have already paid the tax on your options when you exercised and

can therefore diversify at almost no tax cost. Rather than try and

time AMT tax credits and other matters that look attractive on paper, see

the forest. You work for a great innovative company that has provided

remarkable financial rewards to many of you. What is less obvious,

however, is that you have also prepaid your future wages and 80 percent

of your stock gains have been effectively pilfered from the retirement

system. This occurs for reasons outlined in the Microsoft Financial

Pyramid summary, located in my archive, which is an excellent supplemental

report for any Cisco shareholder.

In addition, there is also a growing realization that

Cisco has become a Microsoft like predatory monopoly. This is a natural

evolution for any organization trying to sustain a pyramid scheme. Already

many struggling telecom firms are seeing declining sales due to competition

yet have not figured out that their back office costs, more specifically

Cisco Systems overpriced products, may put them out of business.

Perhaps most startling to me is that the average Cisco Systems employee

has no idea regarding the level of deception applied to the company's financial

statements, upon which rest many employees financial future.

For those of you Cisco employees that judge me harshly for exposing

this astonishing fraud, please recognize that I did make a strong effort

to inform you first and within two weeks of seeing this report Ralph Nader

himself called a special press conference on the steps of Cisco Systems

to discuss its findings. Your subsequent actions are your own yet

at least, true to the glory of the information age you have helped create,